Volumeleaders.com automatically identifies large odd-lot trades that are of identical size, not divisible by 100,

and printing within 90 days of each other. The assumption is that the first trade opens a new position and

the second trade closes it. Just because two trades are of the same size doesn't mean they have to be related, but when they're so large

and so rare that likelihood of them NOT being related is sufficiently low, we have to consider it as likely.

Since we know that bearish price reversals often occur after institutions exit large long positions, we can

make an educated guess as to how price might behave once we've identified these pair trades. That's exactly

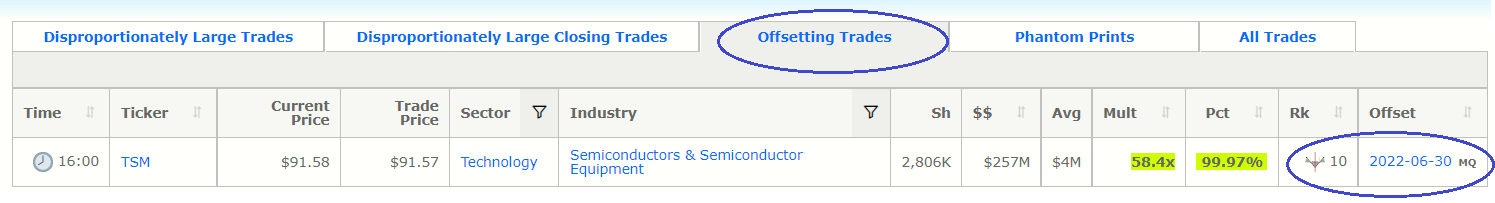

what happened when Volumeleaders identified two very-large offsetting trades in TSM on August 15, 2022.

This tells us that on August 15th, a trade arrived that was of identical size to a trade on the offset date, June 30, 2022.

It also provides additional detail including the size

and rank of this trade. From this screen we gain two key pieces of information:

1) The trades were sufficiently large, as evidenced by the rank (10th largest), the multiplier (58x avg size),

and the rarity (99.97th percentile and largest trade in several weeks).

2) Each trade arrived at opposite ends of a substantial move.

The first trade arrived at $81.75 after months of selling, suggesting institutions were buying into a low, a

low that was struck a week later. The second trade arrived at $91.57 at the end of a decent bounce.

This is actionable information!

By analyzing these two trades, one could conclude that the first trade was institutions opening a long position,

and the second trade was institutions closing that long position, and thus one could surmise that institutions

have reached their upside target and that price should begin to decline.

If you already had a long position in TSM, you would know to close it (or sell calls against it). The probability of further upside is substantially lower now.

If you had a short position moving against you and you were considering closing it, you might decide it was worth holding longer as price was likely

to move in your favor.

If you had no position at all, you could open a short position either by shorting shares or via any number of

bearish options strategies (long puts, bearish call spreads, etc.)

And if you had done any of those, you'd have preserved capital and/or made money because the next day TSM dropped 3 bucks in

the first 40 minutes of trading the next day.

In conclusion, any time we can draw a reasonably probably conclusion about what institutions have done, we can formulate a trading strategy with minimal risk.

Even if we were wrong, and price continued up, we would know that was an area in which institutions were positioned and we could manage our risk accordingly.

Trading in the direction that institutions are pushing price will always yield more profitable results.

|