Friday October 7, 2022

Context

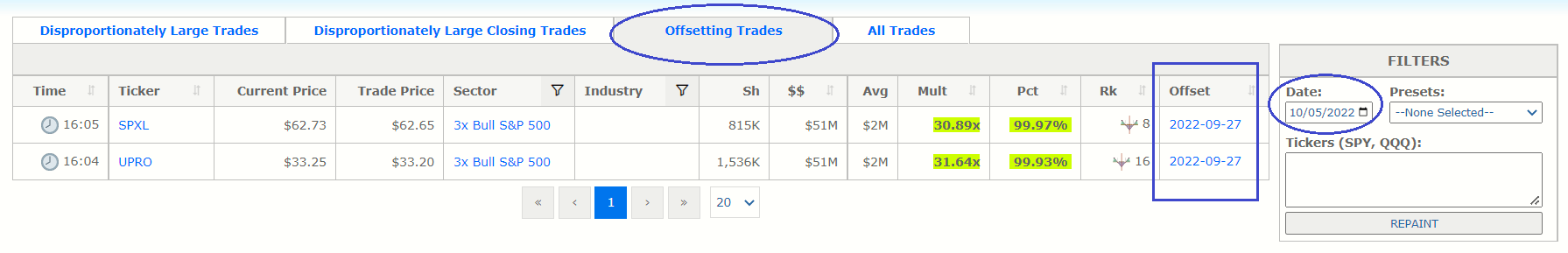

Volumeleaders.com automatically identifies pairs of large odd-lot trades that are of identical size that print within 90 days of each

other. The assertion is that the first is an open and the second is a close. Such trade pairs

don't have to be one open and one close, and we can never know for sure if they are. Trades aren't

labeled and institutions don't announce their intentions so we can't know *exactly* what they're

doing, and we certainly can't know why.

We only know each time a trade occurs. They are atomic. They are discrete. We can't even know if

it's the same institution(s) on both ends of these identified pair-trades.

But it does raise eyebrows when two unusually large trades of the same ETF print a week apart, each

with an odd-lot number of shares, each at opposite ends of a substantial move, with one printing near

a low and one printing near a high. We had that on 10/5 right near the high. We had it twice,

actually, in two very similar ETFs. See below:

SPXL printed 814,763 shares on 9/27/22 and again on 10/5/22.

UPRO printed 1,536,356 shares on 9/27/22 and again on 10/5/22.

On top of that, both trades on 9/27 happened in the same spot, one minute apart,

shortly after the close. The same occurred on 10/5, only they arrived two minutes

apart.

This is easier to visualize by looking at the charts.

Both SPXL and UPRO are comprised of the same instrument (leveraged SPY), and you'll surely

notice that the two charts look nearly identical both as patterns and also with respect

to where each trade printed.

You'll also notice that while each trade didn't catch the exact highs and lows, you can

see they came in pretty close. The entries on 9/27 were a couple days early in terms of

where the actual low was struck, but the exits were right on time. (Institutions

always time their exits better than their entries).

Why do I mention this? It's NOT to endorse trading leveraged ETFs. But as directional

signals go, this was pretty strong.

Institutions leave footprints wherever they go. They aren't always easy to decipher,

but this was a slam dunk. Knowing that institutions had exited these disproportionately

large long positions, I also knew to expect price to retrace in the coming sessions. After all, across 12+ years of trade data, these two closing trades on 10/5 ranked 8th largest and 16th largest respectively, which is substantial and rare. If that much inventory is being let out after a rally, it's natural to assume price will retreat.

The payoff was NFP this morning. I shorted /ES at 8:28am and took 58 points in ~10 minutes,

one of the easiest trades I ever made. I could have held the rest of the day and taken another ~50,

but I like the quick strikes and I didn't want to risk giving any back.

How did I know price would go down regardless of the NFP number? Well, there are no certainties...

but it was a calculated risk based on the assumption that institutions had exited their longs in

two popular SPY ETFs and thus had no further motivation to push price up in this leg. Institutions

had decided two full days before NFP that they were going to sell into it. This suggests the

actual NFP print was already known or immaterial to their decision process. Perhaps both.

So while the financial media spins their wheels on trying to "explain" why the market went down,

what they don't know (or don't tell you) is that it was already staged. NFP as an event was

little more than cover for institutions to do what they already planned on doing 48 hours earlier.

In this case, sell it all.

|