|

Ticker Search: | Getting Started | Register | Videos | Newsletter | Partners | Login |

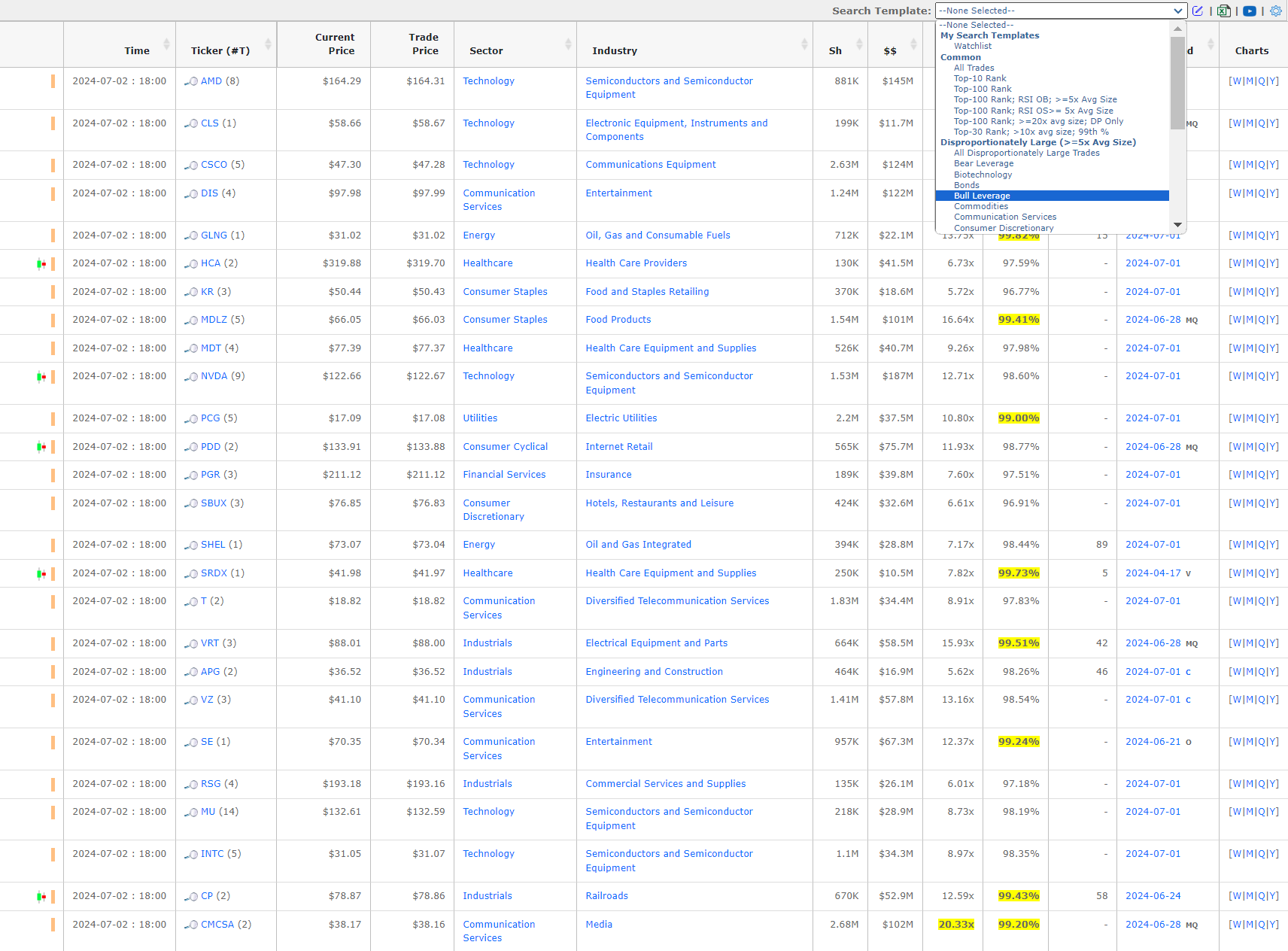

Filter out the noise and focus on the largest trades that are moving markets now and for days, weeks or even months to come. We provide the contextual statistics you need to determine if that large-looking trade is rare or just rather run-of-the-mill.

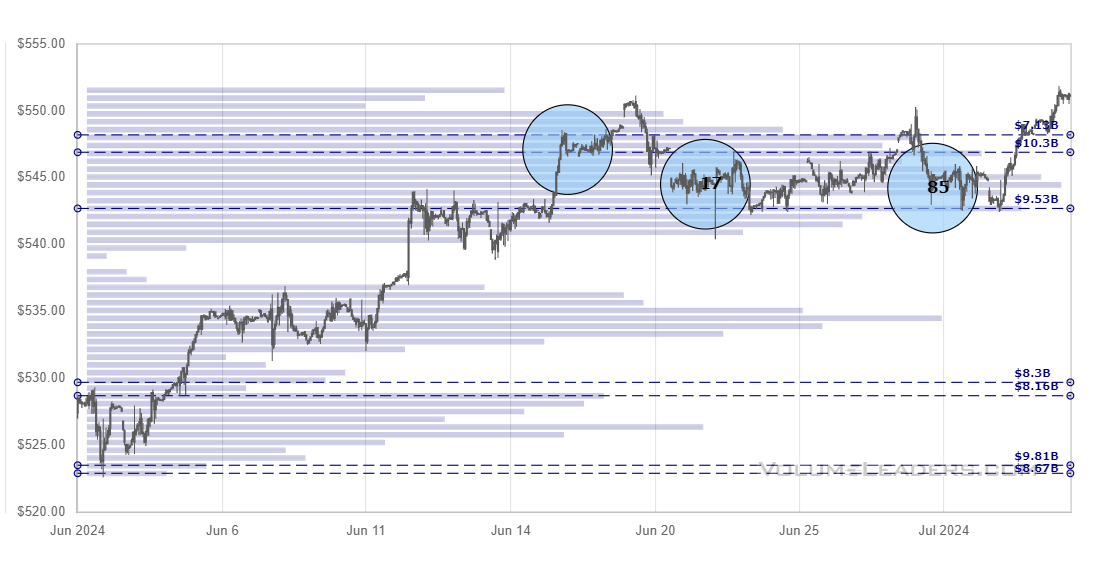

Institutions will frequently attempt to obfucate the amount of business they are doing by campaigning over a range. We collect all of that data so you clearly see the most important price levels to measure buyer or seller success on a given day, and provide contextual metrics for each cluster.

With over 20 years of historical data, VL automatically calculates the price levels at which institutions are most active, and thus where price is most likely to revisit. Each level comes with its own contextual metrics to describe its size, rarity, is searchable, and is automatically plotted on charts.

These are dark pool trades that appear on the tape even though price has not traded that price on the day of their arrival. They are frequently a clear sign of manipulation and can be a useful clue in determining short-term direction for a ticker.

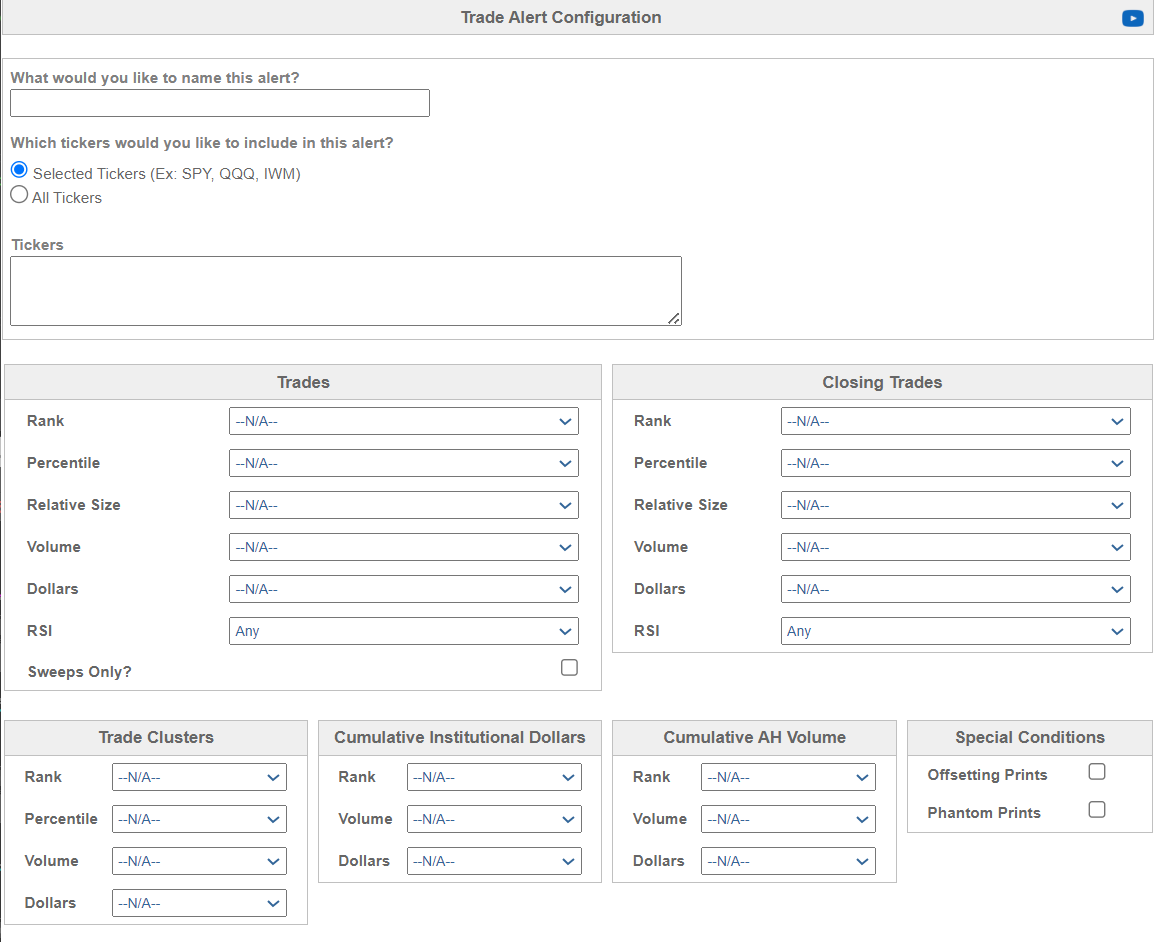

Our signature matching algorithm can make detect when certain positions are being unwound and let you know so that you can exit when institutions do.

Knowing which tickers are most active relative to each other on a given day is valuable, but knowing when a ticker is more active than its every been before provides valuable context. Track cumulative institutional activity both during and after hours, and measure it against all other days since inception.

Unlimited access to proprietary analytics for all tickers on U.S. exchanges. Includes email alerts, private Discord access, substack newsletter access and unlimited support. Price for monthly subscription; yearly and quarterly subscription packages are also available.

Unlimited access to proprietary analytics for all tickers on U.S. exchanges. Includes email alerts, private Discord access, substack newsletter access and unlimited support. Price for monthly subscription; yearly and quarterly subscription packages are also available.

Unlimited access to proprietary analytics for all tickers on U.S. exchanges. Includes email alerts, private Discord access, substack newsletter access and unlimited support. Price for monthly subscription; yearly and quarterly subscription packages are also available.

...One of the best services out there! This takes institutional prints to a whole new level. ...I'm actually worried you'll make a ton of money and just shut down the service...please don't close 😜😅

This week has arguably been the best trading week of my life. I'm about to tweet "Volumeleaders is the cheat code, go subscribe now" 😛

Thank you for the natgas videos lately...Your videos helped me make a couple of good decisions that I wouldn't have made without the insights from your platform. I rode KOLD up then jumped on BOIL. Thanks again for the fun ride!

AMD trade 117x...looking at instututional trades clustered and organized the way it is on VL is absolutely awesome. All you have to do is look the top trades of the day for any ticker and play off levels. It's great

Such an amazing and powerful platform. I've been a customer for a couple of months now and overall absolutely love your site! 🔥